Post-Closing Trial Balance Entries & Examples What is a Post-Closing Trial Balance? Video & Lesson Transcript

The post-closing trial balance proves debits still equal credits after the closing entries have been made. Explore what post-closing trial balance is, see its purpose and the difference from adjusted and unadjusted trial The Post‐closing Trial Balance balance, and see examples of post-closing entries. Other than the post-closing trial balance, there are two other trial balances with their own unique characteristics; unadjusted trial balance and adjusted trial balance.

- All accounts with debit balances are listed on the left column and all accounts with credit balances are listed on the right column.

- When accounting software is used, the totals should always be identical.

- This makes sense because all of the income statement accounts have been closed and no longer have a current balance.

- You have been exposed to the concepts of recording and journalizing transactions previously, but this explains the rest of the accounting process.

- Revenue, expenses and dividends do not show up on the post-closing trial balance because they are considered temporary accounts.

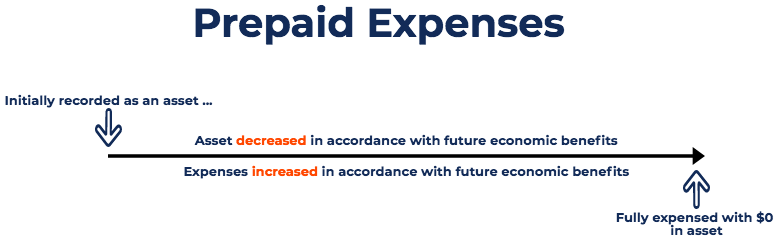

Temporary accounts are accounts that are not always a part of a company’s chart of accounts. The balances in temporary accounts are zeroed out at the end of each accounting period by transferring them to a permanent account. The reason for this is so that they can be used again in the next accounting period. Once the post-closing https://accounting-services.net/contra-inventory-account-accountingtools/ trial balance is run, and the verification is made that the sum of all the debits is equal to the sum of all the credits, then and only then is the accounting cycle complete. As with the unadjusted and adjusted trial balances, both the debit and credit columns are calculated at the bottom of a trial balance.

Next Step

You need the Report Customization permission to customize this report in the Financial Report Builder or to change the layouts assigned to them. For information, see Financial Report Builder and Financial Statement Layouts. By summing the debits together, and the credits together, we see that each reconcile to $2,120 in August. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent.

In other words, the post closing trial balance is a list of accounts or permanent accounts that still have balances after the closing entries have been made. All temporary accounts with zero balances were left out of this statement. Unlike previous trial balances, the retained earnings figure is included, which was obtained through the closing process. It ensures that at the end of an accounting period, the sum of the total debits is equal to the sum of the total credits. The post-closing trial balance gives a listing of each permanent account that a company has and its balance. Now that the post closing trial balance is prepared and checked for errors, Paul can start recording any necessary reversing entries before the start of the next accounting period.

What is the purpose of a post-closing trial balance?

Now that we have completed the accounting cycle, let’s take a look at another way the adjusted trial balance assists users of information with financial decision-making. You have been exposed to the concepts of recording and journalizing transactions previously, but this explains the rest of the accounting process. The accounting cycle is the repetitive set of steps that must occur in every business every period in order to meet reporting requirements.

The ninth, and typically final, step of the process is to prepare a post-closing trial balance. The word “post” in this instance means “after.” You are preparing a trial balance after the closing entries are complete. Running a trial balance is a must for anyone manually recording financial transactions since it helps to make sure that debits and credits are in balance — which is the core principle of double-entry accounting. Closing temporary accounts is an important step in the accounting cycle, and running the post-closing trial balance helps to make sure that the process has been completed accurately. Once your adjusted trial balance has been completed, you’re ready to record post-closing entries for the month.

Post-Closing Trial Balance vs Other Trial Balances

Once the adjustments have been posted, you would then run an adjusted trial balance. Before you can run a post-closing trial balance, you’ll have to make sure that all of your adjusting journal entries have been entered. A post-closing trial balance is a report that is run to verify that all temporary accounts have been closed and their beginning balance reset to zero. A post-closing trial balance is a trial balance taken after the closing entries have been posted.

It will have three columns (account names, debit and a credit column). Like an unadjusted or an adjusted trial balance, it will have accounts listed in order of either their account numbers or in the order they appear on the balance sheet. The order that will follow will be assets first, then liabilities and finally ending off with equity. Revenue, expenses and dividends do not show up on the post-closing trial balance because they are considered temporary accounts. Temporary accounts are accounts whose balances are zeroed out at the end of each accounting period. When a new accounting period opens, these accounts are used again and will accrue balances until the accounting period comes to an end.

The post-closing trial balances shows only the permanent account closing balances. If you’re not using accounting software, consider using a trial balance worksheet, which can be used to calculate account totals. After Paul’s Guitar Shop posted its closing journal entries in the previous example, it can prepare this post closing trial balance.

- This means that there is no error while posting the closing entries to their individual accounts and then listing those account balances on the post-closing trial balance.

- The purpose of closing entries is to transfer the balances of the temporary accounts (expenses, revenues, gains, etc.) to the retained earnings account.

- Each account balance is transferred from their ledger accounts to the post-closing trial balance.

- The post-closing trial balance proves debits still equal credits after the closing entries have been made.